Introduction:

- To simplify the indirect taxation system, India implemented the Goods and Services Tax (GST), a major tax reform. In order to take advantage of the benefits of the GST regime and to comply with legal requirements, businesses must first register with the GST.

Section 1: What is GST?

The VAT, service tax, excise duty, and other separate indirect taxes were superseded by the goods and services tax (GST), which is a single indirect tax. It is imposed at the time of consumption because it is a destination-based tax.

Section 2: Importance of GST Registration:

- Legal Requirement: Businesses with yearly turnovers over the specified threshold level are required to register for GST. It guarantees adherence to the law and keeps one from facing legal repercussions.

- Reputation for Businesses: Businesses who are registered demonstrate their dedication to adhering to tax laws, which enhances their reputation. GST-registered companies can increase cost efficiency by claiming input tax credit (ITC) on taxes paid on purchases.

- Input Tax Credit (ITC): To increase cost efficiency, GST-registered companies are eligible to claim an input tax credit on the taxes paid on purchases.

- Interstate Business: In order to transfer goods smoothly across state boundaries, enterprises involved in interstate trade must register for GST.

FOR LINK :-GST REGISTRATION

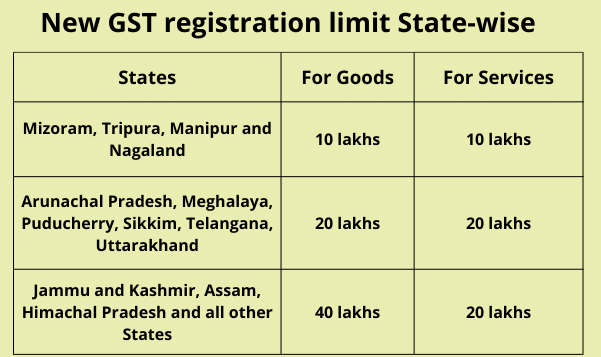

Section 3: Threshold Limit for GST Registration:

- Depending on the kind of business and its location, there are several threshold limits for GST registration. Businesses must register under GST as of [current year] if their total revenue exceeds Rs. 40 lakhs (Rs. 10 lakhs for states under special categories).

Section 4: GST Registration Types

Regular GST Registration: For companies with annual revenue more than the threshold. The Composition Scheme is accessible to small companies with annual sales of up to Rs. 1.5 crores. Although the tax rate is reduced, the company is unable to collect taxes from clients. Casual Taxable Person: For enterprises operating temporarily, such as event-based traders. Non-Resident Taxable Person: For non-residents engaged in taxable supply in India.

Section 5: Records Needed to Register for Goods and Services

- The applicant’s PAN card as evidence of business registration

- Proof of the Promoters’ Identity and Address;

- Bank Account Information;

- Digital Signature;

Section 6: GST Registration Procedure

Online Application: The GST portal serves as the main online platform for the GST registration process. Verification: The GST officer verifies the provided documentation. Issuance of GSTIN: The applicant is given a distinct GST Identification Number (GSTIN) following a successful verification.

Section 7: Challenges in GST Registration:

- Technical Difficulties: There could be delays in the online registration procedure due to technical problems.

- Document Verification: The process of verifying documents might occasionally take a long time.

- Complexity: For new enterprises, it might be difficult to comprehend the different forms and procedures.

Section 8: Compliance with Post-GST Registration:

- Filling Out GST Returns: Companies that are registered are required to submit regular GST returns with information about their sales and purchases.

- Audit and Assessment: To guarantee accuracy and conformity with returns, GST authorities may carry out audits.

- Amendment of Registration: If a business has any changes, they can ask to have their registration information amended.

Conclusion:

To sum up, GST registration is an essential prerequisite for Indian enterprises. It not only guarantees adherence to the law but also provides access to a number of advantages and chances for advancement. Businesses must comprehend the various registration options, the registration procedure, and post-registration compliance in order to effectively manage the GST environment.

Note: For the most current and up-to-date information, it is advised to visit the official GST portal or speak with a tax professional.