GST

GST India implemented a new tax structure on July 1st, 2017, with the goal of turning the whole country into a single market. This section will assist you in comprehending the fundamentals of the “Good and Simple Tax” if you are new to GST and are curious about how this new tax will affect you and your company.

Best practice’s A single value-Added tax known as GST is applied to the production, retail, and domestic consumption of goods and services. Stated differently, the products and Services Tax (GST) is imposed on the provision of products and services.

Every value addition is subject to the comprehensive, multi-strategy, destination-based Goods and Services Tax Law in India. For the whole nation, there is only one domestic indirect tax law, or GST.

Put otherwise, the provision of goods and services is subject to the Goods and Service Tax GST. Every value addition is subject to the comprehensive, multi Platform, destination-based Goods and Services Tax Law in India. For the whole nation, there is only one domestic indirect tax law, or GST.

FOR GST MORE DETAIL:- GST-CLICKER

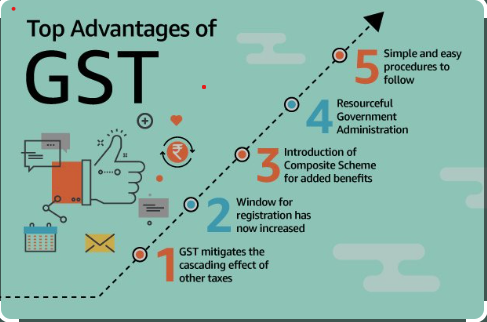

Advantages of GST

Improved efficiency of logistics

- In the past, India’s logistics sector had to keep up a number of warehouses spread throughout several states in order to evade state entry taxes and the central sales tax. Due to the necessity of operating below capacity, many warehouses saw a rise in operating expenses. However, these limitations on the interstate transportation of commodities have been loosened under the GST. Due to the GST, rather than choosing to locate their warehouses in every city along their delivery route, warehouse operators and e-commerce aggregators have expressed interest in locating their facilities in strategic places like Nagpur, the zero-mile city of India. Businesses engaged in the delivery of goods are already seeing an increase in earnings due to the reduction of needless logistics expenses.

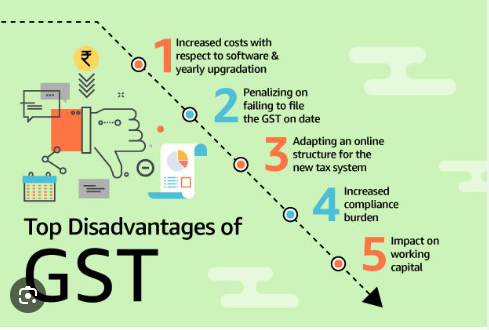

Disadvantages of GST

Not being GST-compliant can attract penalties in law

- Every month, a large number of small enterprises in India adjust to the changes in the GST.

- They had to learn how to create invoices that complied with GST, maintain digital records in a compliant manner, and, of course, file returns on time when the law was initially adopted.

- Thus, among other required information, the GST-compliant invoice that was issued ought to have included the GSTIN, the location of supply, HSN codes, and other details.

- The GST PORTAL platform makes it simple to import these identical invoices using a variety of ways for accurate return submission.

Objectives Of GST

To achieve the ideology of ‘One Nation, One Tax’

Several indirect levies that were in force under the former tax system have been replaced by the GST. The benefit of a single tax is that each state charges the same amount for a given good or service. The Central Government sets the tax rates and policies, making tax administration simpler. Common laws, such e-way bills for the transportation of goods and e-invoicing for transaction reporting, may be introduced. Additionally, since taxpayers are not burdened by numerous return forms and deadlines, tax compliance is improved. All things considered, it’s a single indirect tax compliance system.

To subsume a majority of the indirect taxes in India

Value Added Tax (VAT), Central Excise, service tax, and other former indirect taxes were previously imposed in India at various levels of the supply chain. The federal government oversaw certain taxes while the states oversaw others. A single, centralized tax on products and services did not exist. Thus, the GST was implemented. The main indirect taxes were combined into one under the GST. It has made tax administration easier for the government and significantly lessened the burden of compliance for taxpayers.

To eliminate the cascading effect of taxes

Eliminating the cascading effect of taxes was one of the main goals of the GST. Taxpayers were previously unable to offset the tax credits from one tax against the other because of disparate indirect tax legislation. For instance, the VAT due at the time of sale could not be offset by the excise taxes paid during manufacture. Taxes cascaded as a result of this. Only the net value contributed at each stage of the supply chain is subject to taxation under the GST. As a result, the cascading effect of taxes has been lessened, and input tax credits for both goods and services are now flowing smoothly.

To curb tax evasion

India’s GST laws are significantly stricter than any of the previous indirect tax legislation. Taxpayers are limited to claiming an input tax credit under GST on invoices uploaded by their individual suppliers. In this manner, there is no possibility of obtaining input tax credits on fraudulent invoices. This goal has been strengthened even further with the advent of e-invoicing. The fact that the GST is a national tax and has a centralized monitoring system also makes the crackdown on noncompliant individuals faster and considerably more effective. As a result, GST has significantly reduced the incidence of tax fraud and reduced tax evasion.

Direct tax

This tax is imposed directly on the taxpayer, who must pay it to the government and cannot defer it to another party. Income tax, corporation tax, wealth tax, gift tax, spending tax, and other tax types are examples of direct taxes.

Indirect Tax

It’s a tax that the government imposes on products and services rather than on an individual’s income, profit, or revenue, and it can be transferred from one taxpayer to another. Sales tax, excise duty, VAT, service tax, entertainment tax, custom duty, and so on are a few instances of indirect taxes.

Principles of GST

It is possible to state that GST is founded on two ideas:

1. The Principle of Destination

2. The Principle of Value Added

Destination Principle :The ‘Destination Principle’ proposes that taxes should be applied to the supply of goods and services at the place of consumption. This indicates that the destination-based tax regime is replaced by the GST with the source-based tax system.

Value Added Principle: On the other hand, the “Value Added Principle” emphasizes that taxes must be paid on the value added to goods and services at every point along the supply chain. GST will be gathered on value added at every link in the supply chain, from the initial manufacturer or service provider to the final customer.

Need/Reasons for GST

The different types of GST are as follows :

Central GST (CGST): Each transaction’s GST is split into two equal halves, with the portion pertaining to the Center being referred to as CGST.

State Goods and Services Tax (SGST): SGST is the portion of a state’s share of GST that is applied to transactions that occur within the state.

Union territory GST (UGST): The portion of GST that the union territories (UTs) that do not have a legislature receive are known as UGST.

Integrated GST (IGST): IGST is imposed without a split on the relevant GST rate for transactions that occur between two states or union territories or between a state or union territory and any foreign jurisdiction.

What is GSTR-1?

With a few exceptions listed in later sections, every registered GST taxpayer is required to complete a GSTR-1 monthly or quarterly return. It includes information about all sales and external supply.

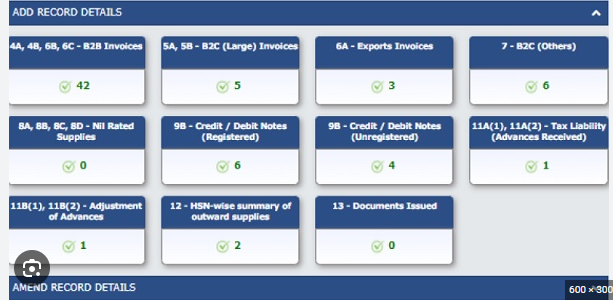

There are 13 sections in all, which are arranged as follows:

Tables 1, 2 & 3: GSTIN, legal and trade names, and aggregate turnover in the previous year

Table 4: Taxable outward supplies to registered persons (including UIN-holders) excluding zero-rated supplies and deemed exports

Table 5: Taxable outward inter-state supplies to unregistered persons where the invoice value is more than Rs.2.5 lakh

Table 6: Zero-rated supplies as well as deemed exports

Table 7: Taxable supplies to unregistered persons other than the supplies covered in table 5 (net of debit notes and credit notes)

Table 8: Outward supplies that are nil rated, exempted and non-GST in nature

Table 9: Amendments to outward supplies that are taxable and reported in table 4,5 & 6 of the earlier tax periods’ GSTR-1 return (including debit notes, credit notes, refund vouchers issued during the current period)

Table 10: Debit note and credit note issued to unregistered person

Table 11: Details of advances received or adjusted in the current tax period or amendments of the information reported in the earlier tax period.

Table 12: Outward supplies summary based on HSN codes

Table 13: Documents issued during the period.

Table 14: For suppliers – Reporting ECO operators’ GSTIN-wise sales through e-commerce operators on which e-commerce operators are liable to collect TCS u/s 52 or liable to pay tax u/s 9(5) of the CGST Act

Table 14A: For suppliers – Amendments to Table 14

Table 15: For e-commerce operators – Reporting both B2B and B2C, suppliers’ GSTIN-wise sales through e-commerce operators on which e-commerce operator must deposit TCS u/s 9(5) of the CGST Act

Table 15A: For e-commerce operators –

Table 15A I – Amendments to Table 15 for sales to GST registered persons (B2B)

Table 15A II – Amendments to Table 15 for sales to unregistered persons (B2C)